43% of Fraudulent Financial Transactions are Authorized

October 29, 2024

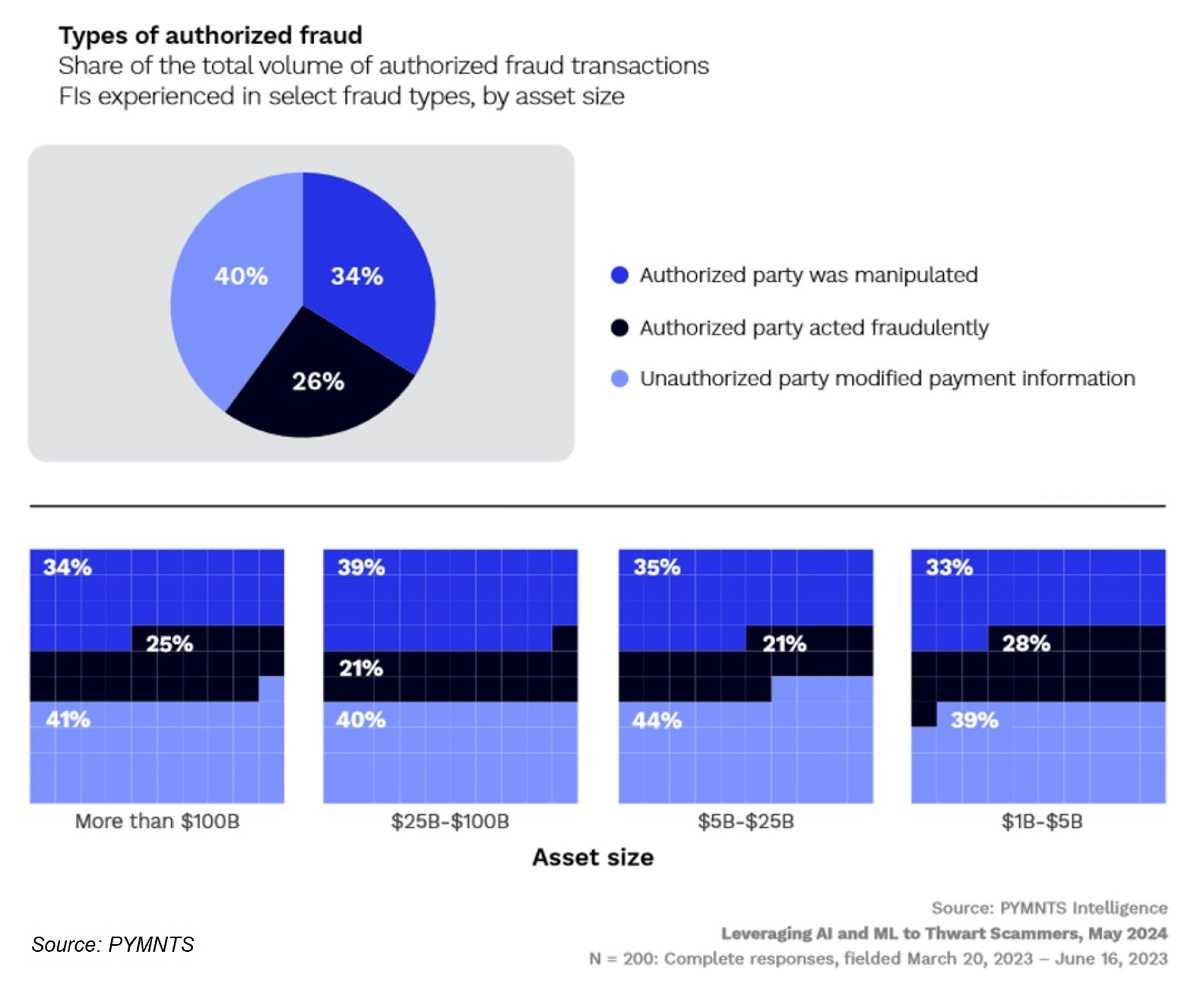

Financial transactions are increasingly under attack according to financial institutions (FIs). They report 43% of all fraudulent transactions involving customers are in the category called “authorized fraud.” This fraud not only costs FIs financially, but some customers lose trust in their FI and that leads to customer retention problems. Fortunately, there’s new optimism using AI (artificial intelligence) and ML (machine learning) to combat the escalating problem of authorized fraud.

Authorized Fraud by The Numbers

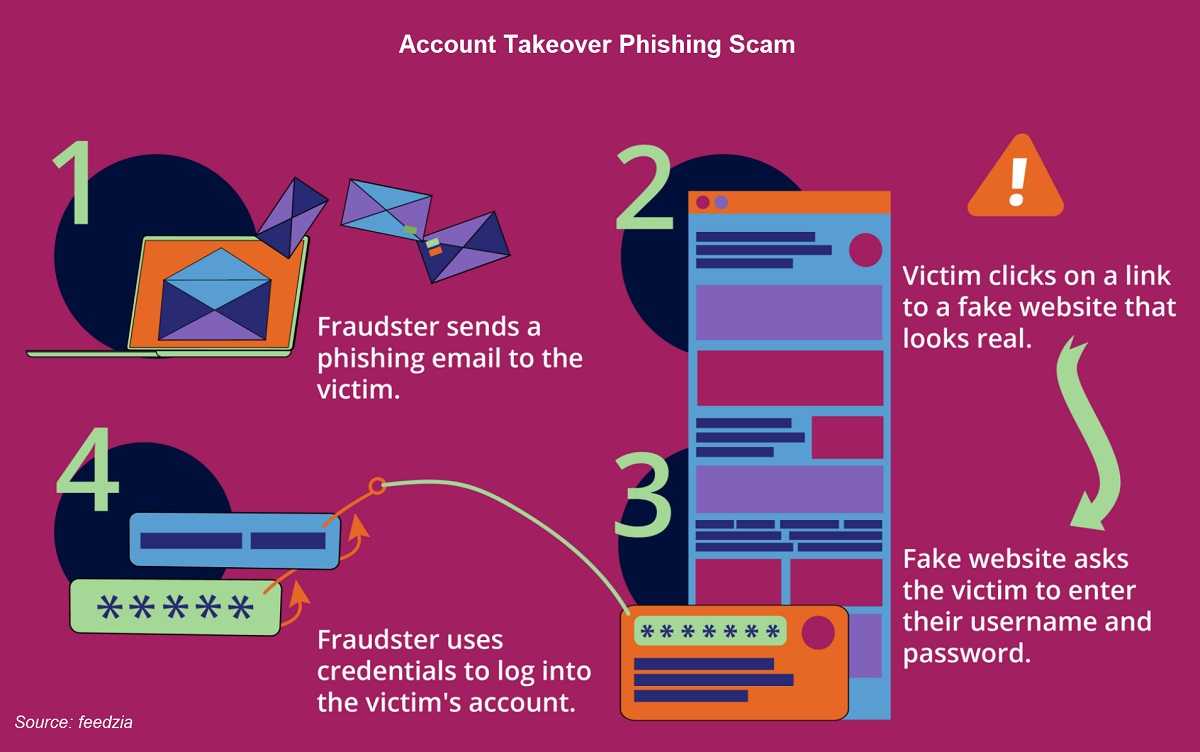

Authorized fraud leaves FIs and their customers on the losing end while scammers enjoy their ill-gotten loot. This type of fraud begins when a customer gets pulled into a scammer’s web, then authorizes payment for the scam they’re pulled into. These legitimate payments are called authorized fraud. Some of the most common scams involve using impostors claiming to be from tech support (63%), utility companies (65%), and the IRS (64%).

The lesson here is to remember a few of the common scams that find success with this type of fraud:

- Post Office, delivery, and logistics scams. A text is received saying they need payment to deliver a package. These organizations will not text you for payment.

- IRS Payment Scams-The IRS will not send you a text or email saying you should pay up or be in trouble with the government. They will send a letter through the U.S. mail to initiate contact.

- Tech support scams-If you receive an unsolicited phone call or text claiming something is wrong with your device and the sender can “help” for a fee, don’t bite. It’s likely a scam. Again, if you need help with your tech devices, you should be the one initiating the call for help.

- Utility scams-If you receive notification about an unpaid utility bill, call the utility separately.

- Romance scams-If you meet someone, especially online, and they ask for money, consider whether it's worth the risk of fraud. These scams are common and if you willingly send money and find out later that it's fraud, you could be out that money.

It’s not just customers on the losing end of authorized fraud since many FIs reimburse their hijacked money. PYMNTS Intelligence finds 36% of FIs believe reimbursing these customers shouldn’t be their responsibility. Research shows the global cost of financial crimes and fraud are projected to cost FIs more than $40 billion by 2027.

AI And ML Scam Busters

While authorized fraud makes up 37% of all fraud losses for FIs, the prospect of losing customers is built-in to these crimes. However, using AI and ML to tackle authorized fraud scams are promising tools protecting FIs and their customers. AI analyzes enormous amounts of data in real time, finding suspicious activity linked to fraud. ML algorithms identify deviations from normal transactions, finding unusual patterns and behaviors. Both AI and ML work together keeping fraudulent transactions from happening, and that’s something every FI and their customers can smile about.