There are so many payment apps out there; PayPal, Venmo, and Zelle, for instance and perhaps you’ve probably wondered: Are these apps actually safe? The short answer—yes, if you’re careful. While most peer-to-peer (P2P) apps use encryption to protect your data, scammers are constantly looking for new ways to trick users into giving up their money. And because these apps are often linked directly to your bank account, one mistake can be very costly.

Want to stay safer? Use a payment card when possible—it adds an extra layer of security. If you must connect a bank account, consider using a separate account with limited funds to reduce risk. And definitely, add multifactor authentication (MFA) to your accounts. Most of them now have a few different MFA options. Pick the one that works for you.

Common P2P Scams to Watch For

1. The Fakes: Fake Bank Texts, Fake Fraud Alerts, and Fake Friends

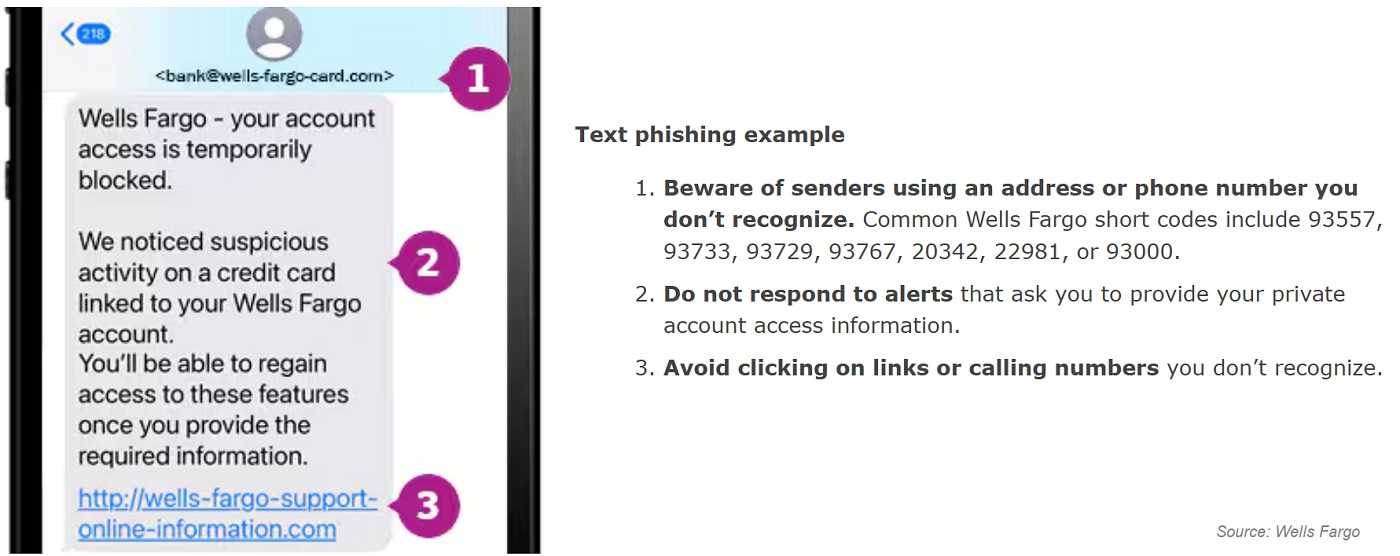

You get a text that looks like it’s from your bank, asking you to confirm a transaction or claiming there is fraud on your card with a convenient link. It’s very likely a scam. Clicking the link can expose your banking details. Instead, contact your financial institution directly—don’t trust links in texts or emails.

You get an urgent text saying your account is locked due to fraud. Scammers count on you panicking and clicking their malicious link. Stay calm. Always log in directly to your banking or payment app to check.

Wells Fargo has recently sent out a message warning its customers about this with regard to debit and credit cards. They warn against someone posing as Wells Fargo sending unexpected calls, texts, or emails asking for your PIN because they saw some fraudulent activity on your account. They go further and claim the bank needs the chip from the card and give you a way to send it to them. But don’t. Financial institutions don’t ask for this information and advise you to shred your cards, including the chips if fraudulent activity occurs.

A scammer creates a profile that looks just like your friend’s and asks for money. It’s common to see “stolen” profiles on social media. Wherever the profile is found, always verify your friend’s request by contacting them through another method before sending cash.

Oops! Accidental Transfers and Overpayment Scams

Selling something online? A buyer “overpays” and asks for the difference to be refunded to another account. This is a red flag. If this happens, refund the money only to the original payment method. But it’s very rare that someone legitimately overpays.

Someone “accidentally” sends you money and asks for it back. This is an old one. Don’t fall for it. It might be stolen funds, but it is definitely a scam. Contact your payment app directly instead of sending money back. Let them help you figure out what happened.

Payday: The “Pay Yourself” Scam

Why would you pay yourself? That’s a great question. Sometimes it’s an easy answer and in some cases, it’s a scammer claiming they’re from your bank saying your account has been compromised. They instruct you to “send money to yourself” via Zelle or Cash App. Spoiler alert: It’s a scam.

If you can’t independently verify the person you’re sending money to via any cash app, don’t send it. Once it’s gone, consider it gone for good.

Winner, Winner, Chicken Dinner!

You receive a message saying you’ve won a giveaway (like a Cash App Friday prize). If they ask for personal info. or a “processing fee,” to claim it, it’s a scam. And if you never even entered a giveaway, well, it’s most definitely a scam.

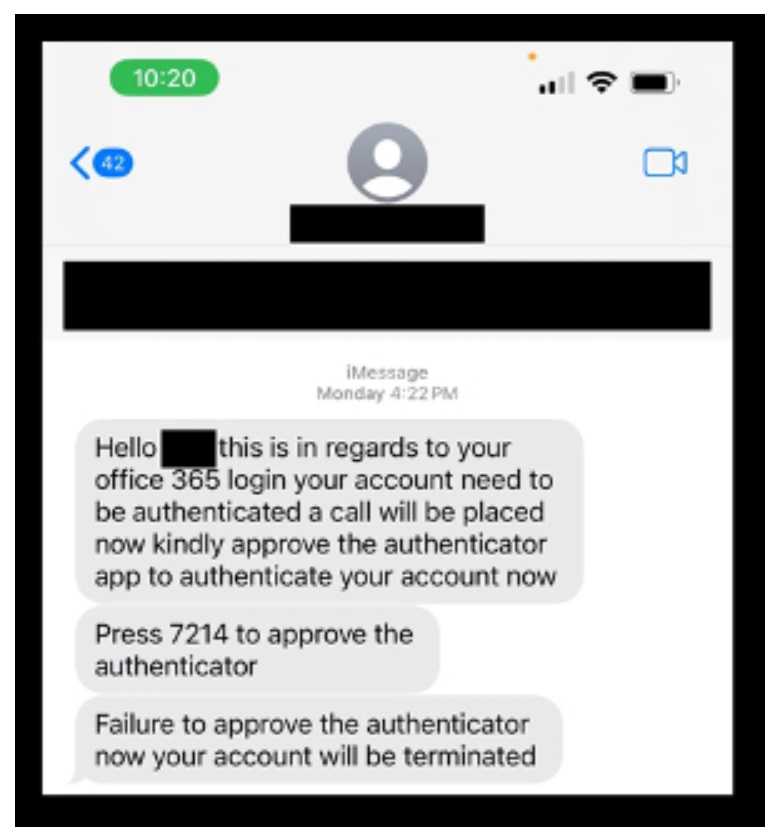

Your Password Has Been Compromised: Password Reset Traps

A random email claims your password for your cash app was changed and urges you to click a link to reset it. Always go to the official app or website instead and log in directly to your account. There is an option to change your password. While you’re there, enable MFA if you haven’t.

A random email claims your password for your cash app was changed and urges you to click a link to reset it. Always go to the official app or website instead and log in directly to your account. There is an option to change your password. While you’re there, enable MFA if you haven’t.

This advice holds true for any password reset message you receive. Don’t click links. Go directly into your account and change it. If it was indeed reset, you’ll find out quickly right then and can do something about it before too much damage is done.

Bottom Line? Think Before You Click.

P2P apps are safe—if you use them safely. Stay skeptical, double-check every request, and never trust a message just because it looks official. AI is making it incredibly difficult to spot a scam these days, so it’s up to us to be extra vigilant. When in doubt, go straight to the source.

If you find yourself a victim of any of these scams, contact the P2P app as well as your financial institution to resolve it. It’s a good idea to report fraud and scams to the FBI at its website. The more they know about them, the more likely they can take some kind of action to thwart them.