Financial Fraud Evolves As Fraudsters Ramp Up Their Attacks

December 11, 2024

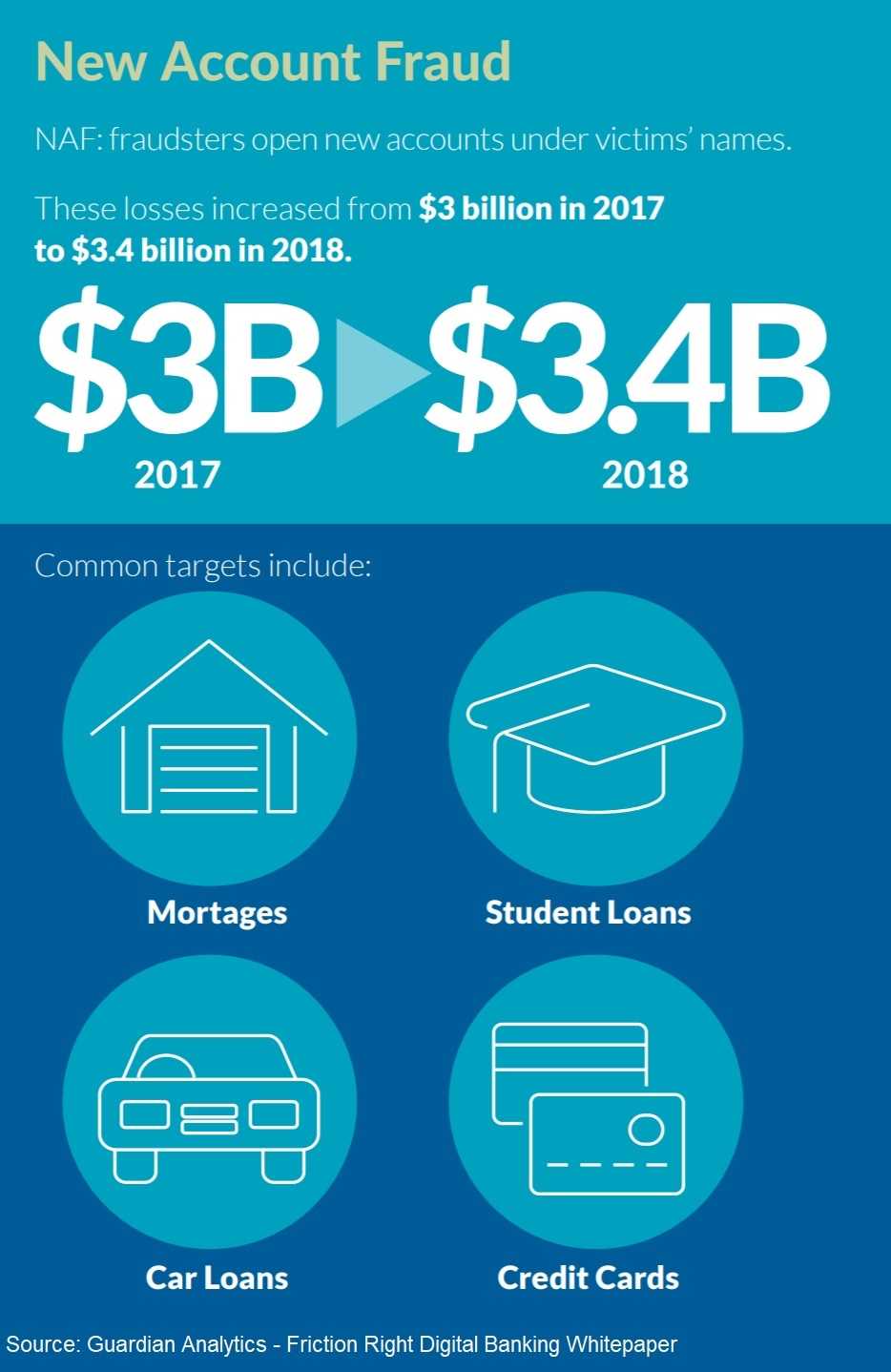

Cybercriminals are stepping-up to the surge in opportunities for financial fraud. The new products and services that financial institutions (FIs) offer to compete for customers, gives fraudsters new avenues to exploit. Expanding banking options give FIs the ability to battle for customers with their marketing approach. But for many FIs and their clients, bad actors are also responding to these banking options. For all the wrong reasons, they too appreciate additional channels for banking, but only as an opportunity to expand their fraudulent attacks.

This multi-faceted FI strategy is called “omnichannel.” With omnichannel banking, customers access banking products and services from virtually anywhere. And now, we know that convenience comes with a hefty price tag. From an internet of things (IoT) perspective, new FI technology adds layers of client services meant to work together, but that’s not what’s happening. Guardian Analytics finds “Many FIs still use standalone solutions from different technology providers that monitor one channel or payment type exclusively. These one-channel solutions create data silos that fail to link together significant data to detect omnichannel attacks.”

This multi-faceted FI strategy is called “omnichannel.” With omnichannel banking, customers access banking products and services from virtually anywhere. And now, we know that convenience comes with a hefty price tag. From an internet of things (IoT) perspective, new FI technology adds layers of client services meant to work together, but that’s not what’s happening. Guardian Analytics finds “Many FIs still use standalone solutions from different technology providers that monitor one channel or payment type exclusively. These one-channel solutions create data silos that fail to link together significant data to detect omnichannel attacks.”

Omnichannel fraud prevention is possible, but FIs are slow to address the solution, for a myriad of reasons. Data from all customer channels need to be connected and analyzed to mitigate the rise in fraud. Keeping a step ahead of bad actors takes a commitment, time, and money to providing comprehensive omnichannel security. In the meantime, as soon as FIs figure out how to stop one type of attack, fraudsters are creating new options to exploit.

Until they can get a handle on it, keep a close eye on financial transactions and immediately report any suspicious activity. In most cases, less damage can be done if fraud is reported within 30 days. Don’t put it off. Remember it isn’t just at a cost to the consumer, client, or customer that occurs. It’s costs the seller and the financial institution as well. Ultimately, that means higher prices for everyone. The sooner it’s dealt with, the less cost to everyone and the less money going into the hackers’ pockets.