Spotlight on Retirement Scams: $3.4 Billion and Counting

January 28, 2025

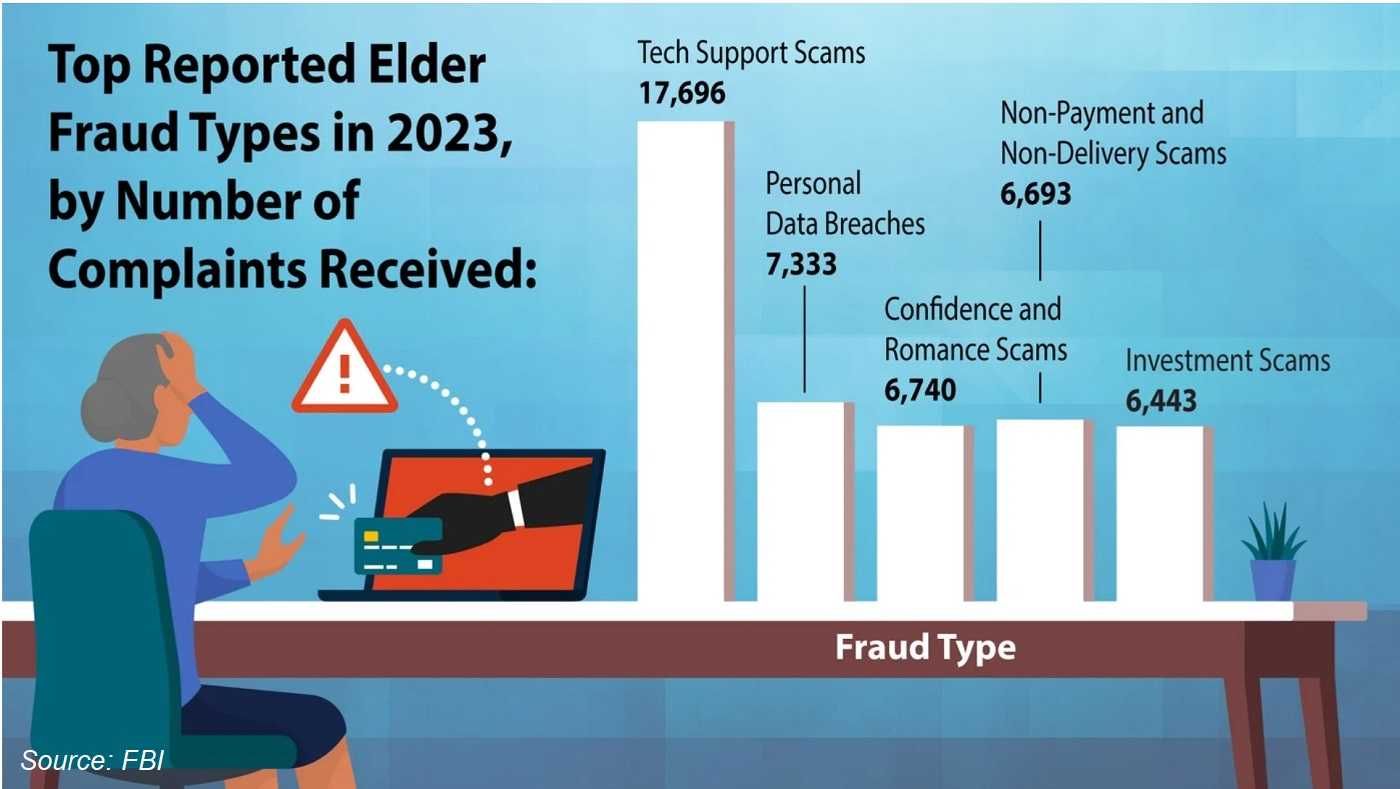

For many online scammers, those in retirement are a target ripe for the picking. The FBI reports retirees aged 60 years and older in the U.S. lost over $3.4 billion to scammers last year—an 11% increase from the year before. Here’s a closer look at common retirement scams and how to know one when you see one…before it’s too late.

(Not-So) Great Investments

What retiree (or anyone else) wouldn’t love the idea of a low-risk, high return investment? The scammer knows the right things to say to win a victim’s confidence, banking account information, and their money. The investments either don’t exist or are not at all what they appear to be.

Phishing For PII

Scammers phish for personally identifiable information (PII), and using legitimate entities like a bank or credit union, government agency, or other trusted source is common. The emails and text messages often demand an urgent response, which may result in a threat if action isn’t taken. Trusting the message, victims respond with their Social Security number, banking and credit card info., and other valuable PII.

Pension Payout Promises

A quick cash advance instead of waiting for future pension payments is a tempting proposition for some retirees. That’s what the scammer promises, but they also deliver insane fees and interest rates for the payout, quickly draining a victim’s retirement funds.

Preventing Retirement Scams

Heartless crooks that they are, retirement scammers are all about gaining a victim’s trust. They know this demographic often lacks tech-savvy necessary to navigate many of today’s tasks, are unfamiliar with the latest scam tactics, and are likely to trust others. Below are tips to help prevent a retirement scam from taking root—for you and your loved ones.

- Approach any money-making opportunity with a healthy dose of skepticism, especially when it sounds too good to be true.

- Always verify an investment opportunity is legitimate before committing. You should always have time to do some research. If not, consider it a scam.

- Ask a trusted financial advisor or family member for their thoughts. Sometimes, they notice something that you may have missed, especially if you were made to feel rushed.

- Keep up-to-date on the latest scam and fraud tricks using trusted sources for information.